Key Notes

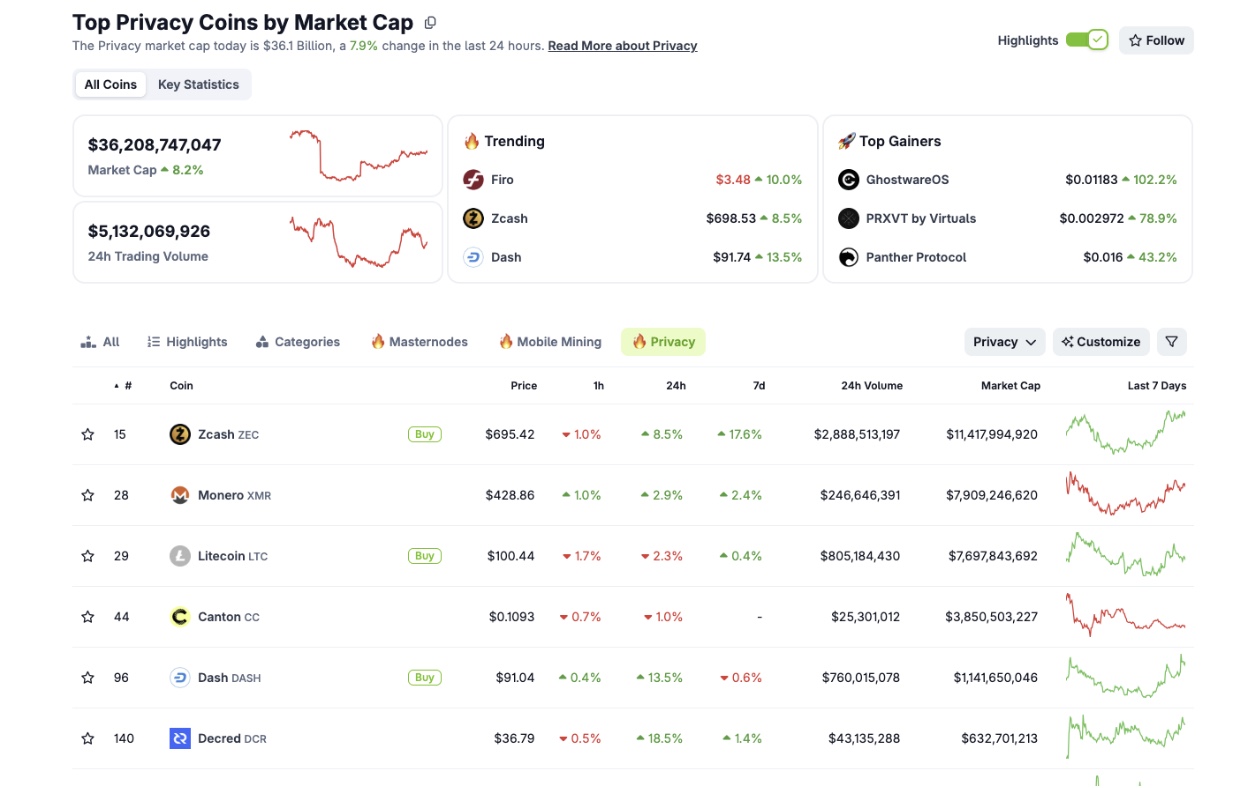

- Privateness-coin marketplace cap surged to $36.1 billion as investors hedge towards emerging US political possibility.

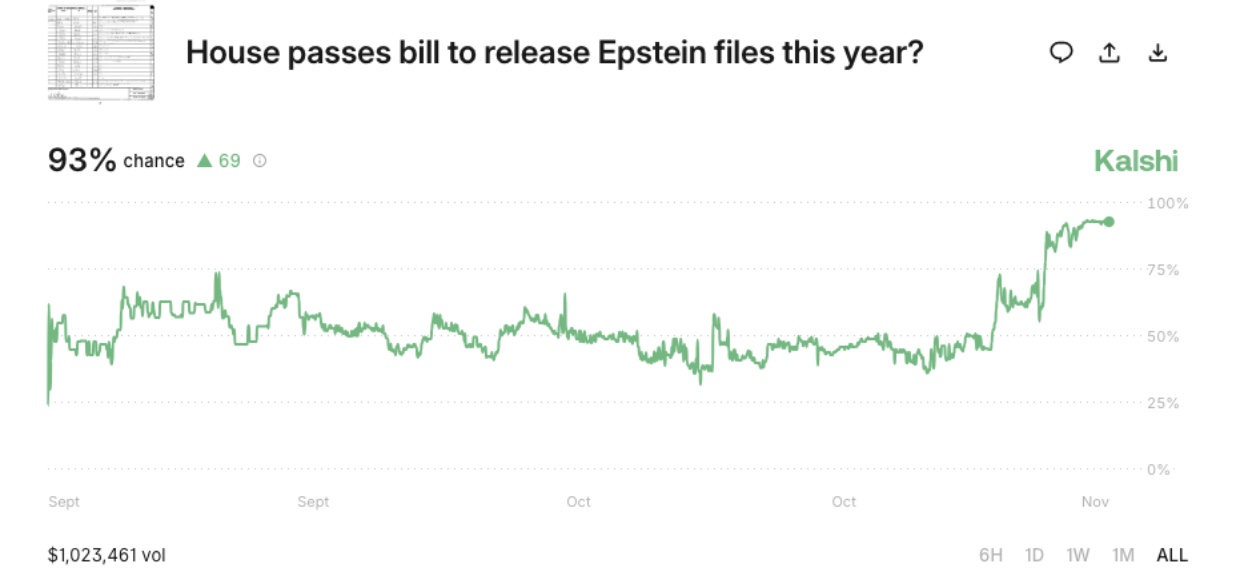

- Prediction markets now value a 93% likelihood Congress forces President Trump to unlock Epstein-related information.

- Zcash, Sprint, and Firo lead positive factors as investors place forward of Tuesday’s high-impact congressional vote.

Because the digested certain tailwinds from the US govt shutdown ended on Wednesday, the comfort rally was once temporarily subdued via controversy round lately disclosed emails reportedly connecting the president to the investigation.

Crypto privateness cash recorded sturdy weekend positive factors as markets reacted to intensifying uncertainty surrounding a a very powerful U.S. congressional vote that would pressure President Trump to unlock sealed information connected to the Epstein case.

Privateness Cash Hit $36 Billion as Investors Hedge In opposition to Trump Scandals

Privateness-focused cryptocurrency property have emerged as a most well-liked edge towards emerging uncertainty surrounding the Trump management’s publicity within the Epstein investigation.

Talking with MS Now on Saturday, Rep. James Walkinshaw, who sits at the Space oversight committee that revealed fresh debatable emails, warned that delaying the discharge of the information threatens democratic balance and dangers additional eroding public accept as true with.

Kalshi prediction markets pricing 93% odds on Space passing invoice to unlock Epstein information | Nov 16, 2025

This rhetoric resonates throughout prediction markets with an energetic Kalshi match appearing investors now assign a 93% likelihood to a Sure vote, compelling report disclosure at Tuesday’s congressional consultation. The development has already generated greater than $1 million in buying and selling quantity as of Sunday midday (GMT)

In crypto spot markets, intraday flows display a transparent selective capital allocation. Whilst the full crypto sector flattened at $3.25 trillion, privateness cash surged 8% to $36.2 billion on Sunday. Zcash led the fee, with investors favoring privacy-focused property to hedge towards swirling political hypothesis in america.

Privateness cash mixture marketplace capitalization crosses $36 billion, Nov 16, 2025 | Supply: Coingecko

Zcash, Sprint, and Firo booked 7.5%, 13%, and 22% positive factors, respectively, and recorded the best possible seek hobby on Sunday as investors take strategic positions towards the danger of a political blowout.

With the vote due in 48 hours, privacy-coin inflows would possibly boost up, in particular as soon as institutional desks reopen on Monday. Grayscale’s Zcash Agree with (ZCSH), introduced in 2017, these days stories greater than $228 million AUM, in step with legit efficiency stories as of Friday, Nov 14.

Disclaimer: Coinspeaker is dedicated to offering impartial and clear reporting. This newsletter objectives to ship correct and well timed data however must now not be taken as monetary or funding recommendation. Since marketplace prerequisites can trade all of a sudden, we inspire you to make sure data by yourself and seek advice from a qualified ahead of making any choices in response to this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting quite a lot of Web3 startups and fiscal organizations. He earned his undergraduate stage in Economics and is these days learning for a Grasp’s in Blockchain and Dispensed Ledger Applied sciences on the College of Malta.