The crypto marketplace crash endured its downtrend lately, Nov. 17, because the Worry and Greed Index plunged to excessive concern and stablecoin alternate outflows jumped.

Abstract

- The crypto marketplace crash endured on Monday, with Bitcoin falling beneath $93,000.

- Stablecoin alternate outflows have sped up prior to now few months.

- The decline came about because the Crypto Worry and Greed Index moved to the intense concern zone.

Bitcoin (BTC) worth dropped beneath $94,000 for the primary time since Might 6, whilst Ethereum (ETH) plunged to $3,020. Probably the most height laggards have been tokens like Sprint, Decred, Telcoin, and Aerodrome Finance, which dropped by means of over 7% within the ultimate 24 hours.

Bitcoin and maximum altcoins have additionally moved to a technical endure marketplace. ETH has dropped by means of 35% from the year-to-date prime, whilst Bitcoin has retreated by means of 25%.

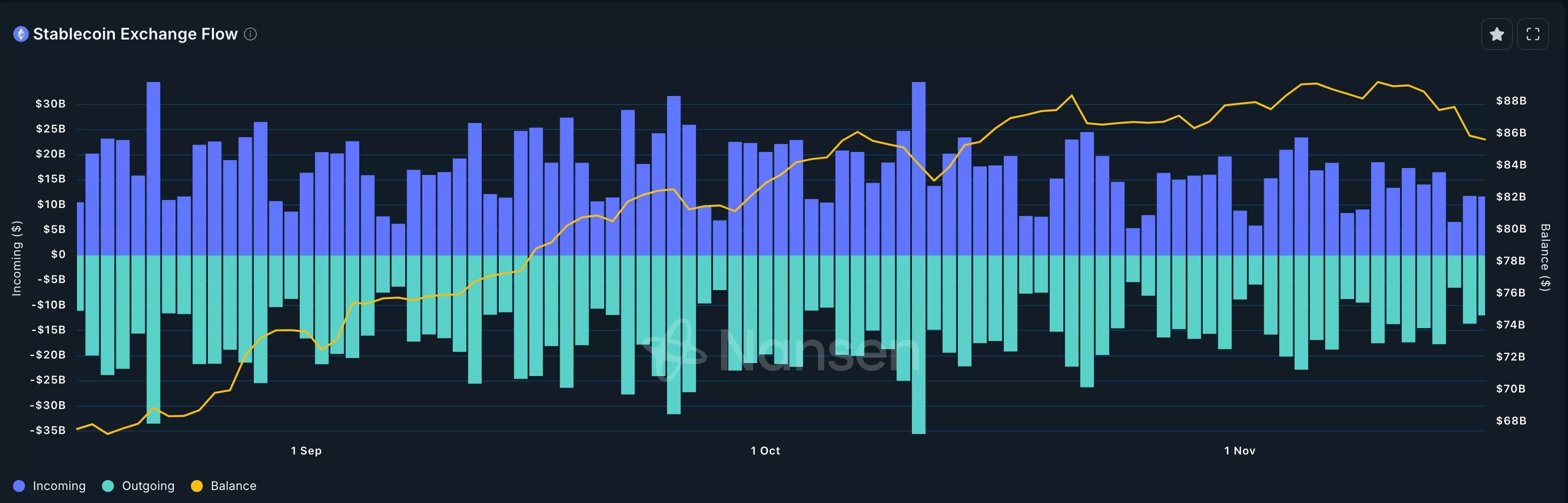

The continued crypto marketplace downturn happened as retail buyers endured promoting their tokens, whilst many remained at the sidelines. Knowledge compiled by means of Nansen presentations that the quantity of stablecoins in exchanges endured to plunge.

The stablecoin alternate steadiness dropped to $85 billion, its lowest stage since October 11. It’s been in a robust downward pattern since Nov. 10 when it peaked at $89 billion. Falling stablecoin balances in exchanges are an indication that buyers are exiting their positions.

The crypto marketplace crash could also be taking place because the Worry and Greed Index continues to freefall. It plunged into the intense concern zone, to 17, its lowest stage since April, when Donald Trump unveiled his reciprocal price lists. Cryptocurrencies generally retreat when buyers are apprehensive and rally when greed is constant.

Bitcoin worth shaped a loss of life go

In the meantime, the crypto marketplace is falling as technicals irritate. For instance, Bitcoin shaped a double-top development at $124,560 and a neckline at $107,276.

It has additionally shaped a loss of life go development, which happens when the 50-day and 200-day Exponential Transferring Averages go downward.

The Reasonable Directional Index has jumped to 35, its very best stage since Might, an indication that the downtrend is gaining momentum. As such, the Bitcoin worth might proceed falling to the necessary fortify stage at $88,790, its very best stage in March.

Having a look forward, the crypto marketplace will react to Nvidia’s income and the FOMC mins, each due Wednesday.

Nvidia, the arena’s greatest corporate, will put up its third-quarter effects, which is able to supply extra colour at the state of the synthetic intelligence trade.

Sturdy effects will imply that the AI trade is doing smartly, which is able to push the inventory marketplace upper, and in all probability cryptocurrencies.

The impending Federal Reserve mins will be offering extra colour at the ultimate assembly and hints on what to anticipate on the December assembly.