Reviews have disclosed that 16 wallets picked up 431,018 Ether between September 25 and 27, spending about $1.73 billion to take action. The buys got here thru names like Kraken, Galaxy Virtual, BitGo, FalconX and OKX.

Similar Studying

That scale of accumulation driven consideration again to who’s purchasing the dip, and why better gamers appear keen so as to add publicity whilst costs wobble.

Change Balances Fall To 9-Yr Low

In step with Glassnode knowledge, the volume of ETH hung on exchanges has plunged from kind of 31 million to about 14.8 million ETH — a drop of 52% from 2016 ranges.

Lots of the ones cash are most probably in staking contracts, chilly wallets or institutional custody, and the new release of the primary Ethereum staking ETF has helped pull extra provide off exchanges.

Decrease trade balances imply fewer cash able to be offered straight away on exchanges, which may make value strikes sharper when giant orders hit the marketplace.

ETH Hovers Close to $4,000 As Volatility Rises

According to TradingView readings, ETH is buying and selling round $4,011, down kind of 0.33% over the past 24 hours and greater than 10% during the last week.

The token in short slipped below $3,980 previous within the consultation sooner than hiking again, and it stays beneath a up to date shut of $4,034.

This two-week pullback has returned ETH to a key $4,000 give a boost to space, and non permanent swings have turn into extra pronounced as holders reposition.

$3,700 Turns into A Line In Sand

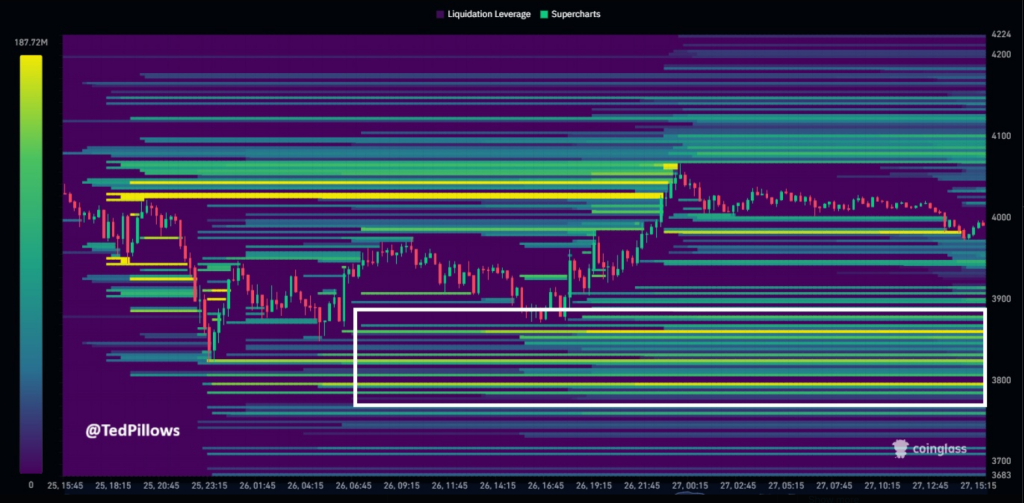

Crypto analyst Ted Pillows has warned that the $3,700 to $3,800 zone may face heavy drive. Reviews observe that if ETH falls beneath $3,700, many margin positions might be burnt up and spark pressured promoting that pushes costs decrease.

$ETH liquidity heatmap is appearing respectable lengthy liquidations across the $3,700-$3,800 degree.

This degree might be revisited once more sooner than Ethereum displays any restoration. percent.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

With fewer cash on exchanges and concentrated margin publicity, the non permanent outlook is extra fragile whilst longer-term call for signs glance cast.

ETF Outflows Display Institutional Temper Can Turn

US-listed ETH price range recorded just about $800 million in outflows this week, their biggest redemptions to this point. Nonetheless, kind of $26 billion sits in Ethereum ETFs, equivalent to five.37% of overall provide.

Whales stay collecting $ETH!

16 wallets have won 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX previously 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ percent.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Similar Studying

The ones numbers underline how briefly institutional sentiment can alternate: giant inflows can vanish simply as rapid, and ETF flows now upload a brand new, sizable layer to value dynamics.

Lookonchain knowledge additionally highlighted a previous accumulation of kind of $204 million in ETH, appearing an identical patterns of huge gamers stepping up all the way through dips.

Retail investors seem extra wary for now. However the series of huge buys from institutional-grade custodians suggests some patrons view dips as purchasing probabilities whilst others make a selection to attend at the sidelines.

Featured symbol from Unsplash, chart from TradingView